Revenue Operations (RevOps) has always been critical to successful go-to-market strategies.

However, the rise of B2B Buying Groups is changing everything. These shifts are transforming how RevOps teams architect systems, define processes, and measure performance.

According to Forrester, 80% of B2B purchases involve complex, multi-person buying groups. As a result, RevOps teams must adapt quickly.

This article explores five predictions for how RevOps will evolve in a world where Buying Groups dominate.

1. RevOps Will Own Buying Group Architecture

Today, most routing and reporting systems in B2B are lead-based or account-based. This no longer reflects how buying decisions are made. Buying Groups require systems that identify and connect multiple stakeholders to active opportunities.

RevOps will become the architect of this new structure. Instead of managing simple lead routing, they will design systems that:

- Group contacts by opportunity and buying role

- Match leads to existing opportunities in real time

- Track individual and collective engagement across the Buying Group

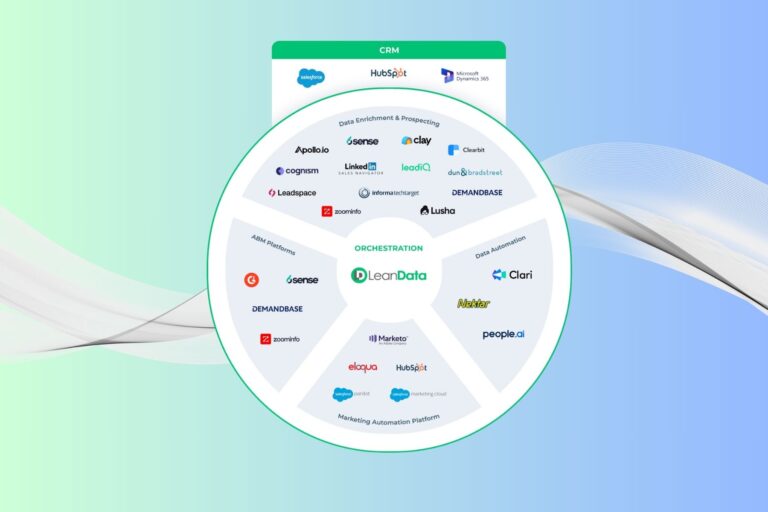

Further, once you know the right accounts and people to engage, your tech stack should help you take action, not just pass information along.

That means automatically routing the right contacts to the right rep, triggering personalized campaigns based on role or journey stage, and alerting sellers when buying group activity crosses a threshold.

2. New Routing Logic Will Emerge Beyond the Lead

In a Buying Groups model, traditional lead routing no longer applies. Instead of routing one lead to one rep, RevOps must consider the broader context.

For example, multiple leads from one account might map to different opportunities. Some may belong to expansion deals. Others might represent new business. Each must be routed with different logic.

Therefore, routing will evolve to include:

- Opportunity ownership and stage

- Buyer role and engagement history

- Existing sales coverage and activity levels

According to Nektar.ai, RevOps will need to support dynamic, multi-threaded routing rules. These rules must evolve as the Buying Group and opportunity progress through the sales cycle.

3. Attribution Models Will Reflect Group Influence

Marketing attribution has traditionally been based on individual activity. Most companies use first-touch or last-touch models. However, these methods fall short when decisions are made by five or more people.

RevOps must shift to attribution models that:

- Track engagement across all stakeholders in a Buying Group

- Weigh influence based on timing, role, and activity type

- Highlight patterns across successful deals

This will require collaboration between RevOps and marketing. Attribution logic must evolve to reflect modern buyer behavior.

Moving forward, attribution should help GTM teams understand which touchpoints influence which roles in a Buying Group. That way, teams can optimize engagement strategies across the full committee.

4. MQLs Will Be Replaced with Opportunity Signals

The traditional Marketing Qualified Lead (MQL) is becoming less useful. It reflects an outdated idea that one person drives a purchase decision.

In contrast, Buying Group models require a shift toward opportunity-level engagement. Instead of scoring individuals, RevOps will surface group-based signals.

Examples include:

- Three or more engaged stakeholders from one account

- Presence of a key buying role, such as an executive sponsor

- High-intent actions from multiple contacts tied to the same opportunity

MQLs often ignore buying intent spread across a group. This leads to missed signals and slower handoffs.

RevOps must define new success criteria based on collective behavior. This shift allows sales to prioritize deals more effectively.

5. RevOps Will Lead Cross-Functional GTM Alignment

Buying Groups touch every part of the GTM team. Marketing engages early. Sales leads the deal. Customer success ensures post-sale success. RevOps is the only function that spans all of them.

Because of this, RevOps will increasingly lead alignment efforts. Teams will rely on RevOps to:

- Maintain shared definitions of opportunity stages and roles

- Ensure data accuracy across systems

- Create unified reporting on Buying Group engagement

According to Revlitix, RevOps must be the engine that drives GTM collaboration. With the right systems and insights, they enable sales, marketing, and success teams to work in sync.

Buying Group models force a unified GTM motion. RevOps becomes the quarterback, ensuring every team plays its part.

The New Frontier for RevOps

The rise of Buying Groups is not a small shift. It changes how revenue teams work, measure success, and win deals.

RevOps leaders should start by auditing their systems. Do your models still rely on lead-based logic? Can your team access opportunity-level insights that are both visible and actionable? Are you capturing signals from multiple buyers across each deal?

Next, work with your GTM partners to redesign routing, scoring, and attribution logic. Use tools that support flexible logic and multi-threaded workflows.

Finally, take a seat at the strategic table. Buying Groups are here to stay. RevOps is the function best positioned to operationalize them.

By embracing this shift, RevOps teams won’t just support revenue growth, they will drive it.