Revenue Operations (RevOps) is more than a role or a function in a business. It can, of course, be both. However, RevOps’ true essence is that of an organizational mindset, a cultural norm to drive predictable revenue across Marketing, Sales and Customer Success through an end-to-end process of transparency and rigorous execution.

Revenue Operations holds a rather unique position in the organization. Done well, RevOps greatly empowers the success of a company’s go-to-market (GTM) flows, spurring the company to grow at scale, and greatly boosting top line revenues.

At the same time, RevOps helps the revenue team run more efficiently, driving growth while at the same time ensuring GTM investments are achieving a maximum return on investment (ROI).

A peak performing RevOps functions drives revenue teams to be both more effective and more efficient, therefore impacting the top and bottom lines.

With the strategic and tactical levers for RevOps to push and pull upon to affect business results, RevOps can be utilized to improve upon a company’s unit economics and, ultimately, drive up the valuation of the organization.

What is the definition of Unit Economics?

For your business, whether B2C or B2B, your unit economics are the sum of all economic/financial activities related to one unit of each product or service you provide to one single customer. It’s an important concept for your business, from the boardroom on down – the long-term valuation of your company depends on it.

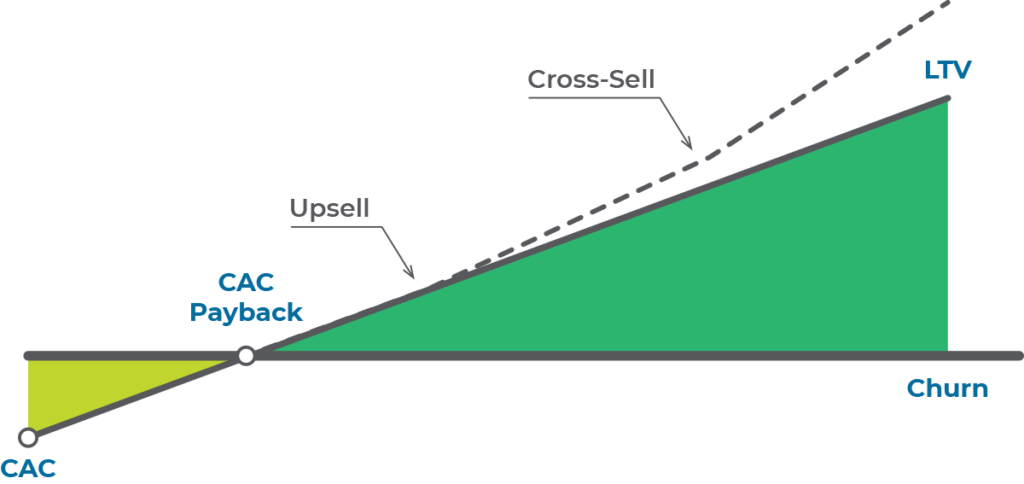

Typically, companies measure unit economics with customer lifetime value (CLV, or sometimes CLTV) and customer acquisition cost (CAC) metrics – especially so in any subscription-based business. Within that model, it’s important to understand both the calculations of each metric, as well as the ratios and interplay between the two.

Spoiler alert: Your CLV should significantly exceed your CAC. For most businesses, the CLV:CAC ratio should be approximately 3:1.

A tighter ratio, like 2:1 for example, indicates potential profitability challenges over the mid- to long-term. A higher ratio, like 8:1 isn’t necessarily good, as it may indicate missing out on potentially profitable customers for lack of Marketing investment – a case of being penny wise but dollar foolish.

Calculating customer acquisition cost

A key component of unit economics, CAC represents one of the most important data points for determining the financial health – and sustainability – of the company. Simply, it answers the question, “How much does it cost to gain a single new customer?,” and it measures the efficiency of your GTM operations.

Customer Acquisition Cost (CAC) = Total Sales & Marketing Expenses / Total Customers Acquired

Simply sum the totality of GTM expenses, including salaries, commissions, program and campaign costs, platform costs and every other dollar and cent across every revenue team function. Additionally, consider calculating your CAC for various time periods, particularly if your business tends to be seasonal.

Your organization’s CAC delivers strong insights when paired with other metrics, like CLV. But, it also adds value by itself, where its trendline helps signal the effectiveness of GTM strategies and initiatives over the mid- and long-term, as well as the impact of GTM efforts on the bottom line.

Calculating customer lifetime value (CLV)

Many organizations embrace recurring revenue business models, particularly B2B SaaS companies and B2C subscription-based companies. However, even non-subscription businesses market for repeat business, and CLV is an effective measurement of the value of customers over time.

CLV = ARPU / Revenue or Customer Churn

For the CLV calculation, you’re dependent on first calculating one of two foundational metrics. ARPU is average revenue per user (or, sometimes, average revenue per unit), and is a straight-forward metric. Customer churn is the rate at which customers leave a subscription-based business, and is calculated by relating canceled subscriptions/lost customers to total customer base over a given time period.

Churn Rate = Lost Customers Over a Period / Total Customers at the End of a Period

An important consideration for CLV calculations is a large enough customer sample size for the calculation to be meaningful. If a company has large numbers of both customers and revenue, there will be low variation in month-to-month changes, unless, of course, the company is doing something either transformationally very right or very wrong.

Low numbers of revenue and/or customers reduce the statistical power of the model. Early stage startups beware: A low number of customers means each individual customer has a greater impact on the LTV calculation for the time period.

Finally, relate your LTV to your CAC to compare the long-term value of customers with the cost it took to your customers. Doing so delivers insights into the viability of your business’ unit economics.

Calculating the Payback Period

The payback period is the time it takes to recoup the CAC. The general benchmark is to have a payback period of 12 months or less. Early-stage startups may have a higher CAC payback periods that fluctuate with growth. Larger enterprises, with greater access to funding and working capital, sometimes have longer payback periods.

RevOps as a Lever to Improve Unit Economics

Revenue Operations touches, in some way or another, the entire unit economics value chain. As a result, RevOps plays a huge role in hitting the right number. Below, find ways to leverage RevOps to both decrease CAC and increase CLV

Decrease CAC with RevOps

- Facilitate the handoffs of leads between functions, from Marketing to Sales Development Representatives (SDRs), from SDRs to Account Executives (AEs), and from AEs to Customer Success Managers to save time in your GTM processes. Reduced time saves costs, lowering your CAC. Reducing time also speeds up time to revenue, which increases LTV, mentioned below.

- Deploy automated solutions to eliminate manual processes that require headcount and associated SG&A (selling, general & administrative) expenses. In addition to requiring headcount, manual processes tend to be error-prone, and errors result in rework and time delays, both of which negatively impact costs. Reducing headcount, and eliminating errors and subsequent rework should provide a positive return on investment of your automated lead management solution. Reducing headcount goes a long way to reducing your CAC and overall payback period. Reallocating headcount allows you to add value in otherwise neglected areas, and impacts LTV, below.

- Perform after-action reviews and debriefs on GTM activations and campaigns with transparent and shared RevOps data. Key here is the constant evolution and validation of your buyer personas. Empower teams to focus on the best keywords and messaging to reach target audiences faster and close deals more quickly. Ensure the best leads are getting qualified and moved through the buyer journey. By identifying the best campaigns and activations, you’re able to invest Marketing spend more wisely, saving costs from ineffective tactics and positively impacting your CAC.

Increase LTV with RevOps

- Automate post-purchase processes, ensuring all inbound leads from existing customer accounts are correctly routed to the appropriate Customer Success representatives and not to Sales. Nothing says “poor customer experience” more than treating an existing customer like a new prospect. RevOps gets your lead-to-account matching processes on point, helping to reduce churn and improve LTV.

- Reallocate headcount made redundant by automated solutions to target friction points in your GTM processes that have been neglected. Adding value throughout the process increases time to revenue and lifts LTV accordingly.

- Deliver value-added content, much like in the purchase cycle, to help customers get the most out of their purchases. Build and share your knowledge base assets, including solutions to common pain points and opportunities for improvement. Avoid canned drip campaigns. Customization and personalization are important qualities to enhance the customer experience and increase LTV.

- Measure engagement with your customers to identify at-risk clients and proactively add value to your products, service and solutions. You’ll reduce churn, and as a result, you’ll improve CLV.

- Utilize RevOps processes and assets to both identify and capitalize on upsell and cross-sell opportunities. If you can show additional value to your trusted customers, then show them how and why. Optimize value for them and they’ll optimize value for you, as reflected by LTV metrics.

Summary

Revenue is the lifeblood of your business, and your unit economics is a critical measurement of your sustainability. RevOps, as either a function or a role, but certainly as an organization mindset, allows an organization to go to market both efficiently and effectively, driving the cost of acquiring customers down while empowering the lifetime value of customers to soar.