Engagement with prospective customer accounts as markets of one is the essence of account-based marketing (ABM). Each named account gets the royal treatment. In effect, you’re marketing to just that singular account.

And, of course, you’re likely repeating that entire marketing process across other similar accounts.

As a result, any account-based motion is only going to be as good as the motion’s targeted account list. This post, the third in a series, provides a behind-the-scenes look at identifying target accounts for LeanData’s own account-based strategy.

Start at the beginning

LeanData’s solutions empower the account-based strategies of its customers. The company’s industry-best lead-to-account matching solution is fundamental to ABM success, and LeanData Engagement Analytics is mission-critical for advancing deals to closed/won.

However, LeanData’s own ABM strategies have had a checkered past, producing some significant wins but generally plagued by an inconsistent effort. The result is an Enterprise segment pipeline marked by variability.

2022 is the year LeanData changes those inconsistent outcomes, and to chronicle the journey, the company is publishing a series of posts to give readers unbridled access to strategies and decisions. You can get caught up by reviewing the previous posts, below:

- The Journey to Effective ABM: Taking the First Steps (January 6)

- The Journey to Effective ABM: Conducting a Diagnostic Assessment (January 21)

Honing the ideal customer profile

An ideal customer profile (ICP) is a description of the type of company that would realize the most value from your product or solution. Importantly, an ICP is not the individual buyer or end user. Buyer personas come later.

An ICP is usually based on data from current customers. It’s taking your “best customers” and developing a conceptual framework around who your next best customers will be. Note: this step can be particularly tricky if your best customer(s) is (are) rather atypical.

Within a dynamic marketplace, it’s a good practice to revisit your ICP periodically. LeanData began its own internal audit in the autumn of 2021.

In revisiting its ICP, LeanData started with Geoffrey Moore’s Hierarchy of Powers framework, as introduced in his book, Escape Velocity: Free Your Company’s Future from the Pull of the Past. For the uninitiated, that hierarchy is as follows:

- Category power – growth potential of the category or your portfolio

- Company power – your company’s differentiation relative to its closest competitors

- Market power – growth & share in your target market segment(s)

- Offer power – differentiation of your company’s offer for each customer set

- Execution power – speed, scale and focus of your actions

Within the Hierarchy of Power framework, the project team at LeanData developed assessment and selection criteria for its ICP. First, any targeted segment needed to be visible, big enough to matter, yet focused enough to allow LeanData to capture meaningful share. Second, prospects in the target segment needed a compelling reason to buy LeanData solutions, suffering from broken processes causing unacceptable losses and/or risks to the organization. Lastly, LeanData needed to be able to map a unique and whole value proposition to prospects, nailing 100 percent of the compelling reason to buy.

The process LeanData undertook is below:

- Analyze existing customer base

- Segment customers with high average account values (AVC)

- Identify macro and micro trends within the segmented customers

- Gather input and validation from internal stakeholders

- Formulate tentative ICPs

ICPs rise to the top

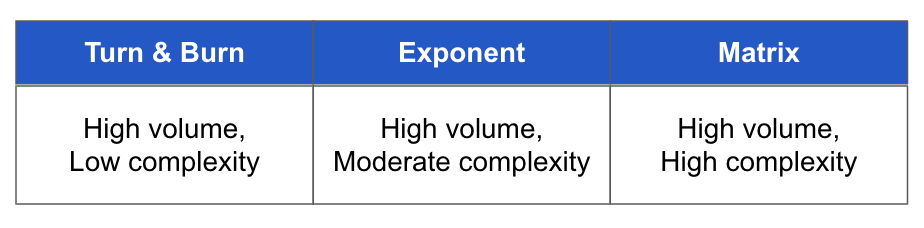

With the framework and process in place, three ICPs emerged, each differentiated by the complexity of their lead routing.

On one end of the spectrum was a segment we designated “Turn & Burn,” characterized by having high lead record volumes, but low lead routing complexity. At the far end of the spectrum was “The Matrix” ICP, characterized by high lead record volumes along with high lead routing complexity. Nestled neatly between the two were “The Exponent,” defined as those organizations with high lead record volumes and a moderate lead record complexity.

Analysis of the ICPs went beyond those key characteristics and included notable attributes, such as whether the ICP segment tended to be B2B, B2C, or B2B2C, as well as product portfolios, direct versus indirect channels and more. Other data included their compelling reason to buy LeanData solutions, and historical customer data allowed us to draw conclusions on average selling price, average sales cycle and average years of customer retention.

Identifying industries

With more refined ICPs potentially identified, the next step centered on discovering which industries contained those types of companies. Research led us to identify the following industries:

- Business services

- Retail apparel & accessories

- Medical devices & equipment

- Financial services – lending & brokerage services

- Financial services – credit cards & transaction processing

- Transportation – rail, bus & taxi

- Telecommunications

As LeanData is a Salesforce-native application, additional research identified companies who used SFDC. That information allowed LeanData to define the potential total addressable market (TAM) by number of organizations in each industry, as well as the percentage of existing LeanData customers in each. Historical customer data allowed us to draw conclusions on the average ARR (annual recurring revenue) for potential new deals in each industry, in turn leading to the determination of the total serviceable addressable market (SAM).

We thought we had something good going, but we needed validation. That need led to ICP testing.

Testing industries

Before the holiday season, LeanData instituted an in-market test to validate its list of targeted industries for its new ICPs. The test incorporated integrated outbound marketing campaigns targeting companies within our identified industries, along with employees and look-alike audiences. From paid social advertisements to outbound email, a variety of tactics were deployed. Performance and engagement data was collected every step of the way and compared to LeanData’s historical performance (in both the targeted industries and across all industries).

Results from the short test indicated LeanData was on to something. Telcom, medical devices and lending and brokerage all performed better than expected. Alas, retail under-performed expectations. Segmentation within that industry requires LeanData to go back and more closely examine where the best fits lie.

Crunching the data, Marketing leadership determined it wouldn’t be advisable to proactively address all industries. That type of thinking had led to inconsistent ABM efforts – and results – in the past. Rather, it decided to begin its rejuvenated ABM motion with the industry that offered the greatest SAM.

Data guided the decision: LeanData would begin to sow its seeds in the fertile pastures of the telecommunications industry.

From industry to companies

With the identification of Telcom as the industry in which to start, you’d think progressing would be simple and straightforward, right?

Not so fast!

Telcom, as a whole, is incredibly complex. It’s a segmented industry with loads of lines of business (LOBs).

Using the assistance of its analysts like Gartner and Forrester, LeanData refined its gigantic list of potential targeted accounts and focused with laser intensity first on the UCaaS (Unified Communications as a Service) segment, and then on the CCaaS (Contact Center as a Service) segment.

In both segments, LeanData refined its target account lists by first eliminating existing customers, and then eliminating any company that didn’t utilize Salesforce in some way or another. Fortunately, the first criteria offered up a few accounts, but not too many, and the second criteria very few.

Further account research identified the number of Salesforce instances in an organization, allowing a determination of whether all subsidiaries rolled up into one instance or not. Then, accounts were cross-referenced with LeanData’s own SFDC instance to identify the number of leads, contacts and working opportunities already existing in the database.

The targeted account list was finally built for LeanData’s ABM initiative. Currently, continuing research is leading to the development of account-specific data, including contact lists and the like.

Of course, all of this targeted account list work has been, and is being, done in parallel with the creation of LeanData’s ABM “play,” being built in conjunction with LeanData’s key collaborator, Winning By Design. That, however, is another story for another post – stay tuned!

Sharing the journey to effective ABM

This post is the third in our series of articles that shares LeanData’s journey to getting account-based strategies right once and for all. Not yet halfway through, our aim is to share our learning for the benefit of your learning, realizing a rising tide lifts all our boats.

Check out other ABM-theme posts in our ongoing series: