Join LeanData’s CEO Evan Liang, MarTech entrepreneur, cofounder at Marketo and Engagio Jon Miller, and 6Sense’s Research and Thought Leader Kerry Cunningham in an engaging discussion of the business case and internal positioning for Buying Groups as a Go-to-Market motion.

Dive into Buying Groups with perspectives and advice from marketing leaders blazing a trail in this GTM arena. Buying journeys are increasingly complex, with marketers struggling to identify and engage with the correct people at the right time. This webinar will explore the key ways that Buying Groups drive pipeline and revenue.

They’ll share real-world examples of how organizations position Buying Groups internally, and share core metrics for marketing teams adopting the new opportunity-centric model.

Webinar Transcript

Disclaimer:

This transcript was whipped up by a tireless (but occasionally clueless) AI. It might contain some blunders, misheard words, or complete nonsense. Think of it as a quirky cousin of the actual webinar: mostly accurate, but with a few unexpected surprises. For the real deal, check out the original recording. If something seems off, or you find any gems of unintentional comedy, let us know—we could all use a good laugh!

Alice Walker 00:03

Hello, everyone, and welcome to “The Business Case for Buying Groups.” My name is Alice Walker, I’m the Senior Product and Partner Marketing Manager at LeanData. And at the risk of sounding like an SNL host, we have a great show for you today. First, a bit of housekeeping: we are recording this webinar, and it will be emailed to all registered attendees tomorrow. So keep an eye out for that. We do have the chat available, and I see you guys are already using it—that’s awesome! Keep it going. We want to see where everyone is from; we’ve already got someone from outside the States, and we’d love to see if we get any more. Any other comments that you want to add, go ahead and throw them in there. Note that there is a separate section for Q&A, not the same as chat—one tab over. Go ahead and add all of your questions there, and they will be answered in the Q&A session.

Excellent. Moving on to the agenda. First, we’re going to start with a welcome—you have now been welcomed, congratulations. We are going to dive into “Why Buying Groups? Why Now?” and the approach you should take to gain C-suite buy-in, talking about buying groups and ABM. Of course, we’re going to get into some key metrics. And finally, we’ll make sure we’re addressing all of those questions that will just be pouring into that Q&A section. So with that, let’s go ahead and get our panelists up here. We’ll do a bit of an intro. Everybody say hello. John, we’ll go ahead and start with you, then Kerry, and finally Evan, bring it home. Hello.

Kerry Cunningham 01:46

Hi, everybody.

Alice Walker 01:48

Hi, everyone. All right, no bios needed.

Jon Miller 01:52

Hello, hello. Myself as well. But you didn’t just say “say hello.”

Evan Liang 01:58

So, I’ll kick off in terms of backgrounds. Hey, everyone, Evan Liang, CEO and co-founder of LeanData. I’m really excited about the topic today. At LeanData, we often work with companies around revenue orchestration. As part of that, when folks are moving to new go-to-market motions, we are often one of the first vendors they talk to. Early on, our company has been around for 10+ years, working with a lot of companies to move towards ABM, providing technology around that. Recently, we have been seeing this huge movement around buying groups. We have been very fortunate to work with some leading companies around buying groups, such as Siemens, Palo Alto Networks, and Reltio. So, I’m looking forward to sharing the learnings we have around why buying groups are really becoming a big thing and what we’re seeing in our customer base. So maybe I’ll hand it back over to John.

Jon Miller 02:50

Got it. Okay, well, hello, everyone. I’m John Miller. I call myself these days a marketing technology entrepreneur. I’m probably best known as the first CMO and co-founder of Marketo. From Marketo, I was the CEO and founder of a company called Engagio, which is an ABM platform we merged with Demandbase about four years ago. And then about six months ago, I left Demandbase to start working on my next startup in the B2B technology space, exploring how AI will help us reimagine the way some B2B technology works. I talked a lot about buying groups at Demandbase. We believe that Demandbase is the third critical object in a platform. We had leads in Marketo, and then tools like Engagio and Demandbase came along and said, “Hey, now we have accounts.” But we always liked, and yet, we also need this third thing. So, I think that’s what brings me here today.

Kerry Cunningham 03:55

Okay, and I’ll jump in, following these two gentlemen who have done some really amazing things. I haven’t started any companies, but I was an analyst with SiriusDecisions and Forrester for about eight years. My friend Terry Flaherty and I, back in 2016 and 2017, figured out that the lead-based approach to demand generation and revenue production in B2B just doesn’t work very well. That’s not a revelation to anybody—everyone knows it doesn’t work very well. What we saw back then was that when organizations do have opportunities that turn into pipeline and revenue, there are invariably more than one individual who’s on the website filling out forms, or anonymous people on that website filling out forms. That’s really the best way to identify where the next set of opportunities and revenue is going to come from. We built a demand unit waterfall around that concept back then. So, this is great fun for me to have this conversation with these guys.

Alice Walker 05:06

Excellent, thank you. So, with that, let’s dive right in and talk about why buying groups and why now. All three of you have really articulated the length of time you guys have already spent working towards this motion and thinking through buying groups in the larger SaaS space. John, why don’t we start with you? Why do you think we’re seeing so much momentum for this idea now, particularly?

Jon Miller 05:37

Well, I’ll start with the “why.” To me, it’s sort of like the perfect example of Goldilocks and the Three Bears. Years ago, we learned that lead-based marketing was kind of too narrow. Obviously, marketing talks to leads, but sales sell to accounts, which didn’t make sense. It had us focusing on people who weren’t at the right companies. As I’m sure Kerry will talk more about, it misses buying signals by not monitoring engagement across the account. The classic example where leads go wrong is when one person comes to your website and downloads 10 pieces of content. That will fire off as an MQL in any system, but that person may not be a buyer or may not be at the right company. At the same time, if you have 10 people from the same company, a target account, each visiting the website anonymously, none of them would be flagged as an MQL, but there’s clearly something going on. That’s why we started doing ABM.

That was about 10 years ago. In the last five years, we realized that accounts in their own right are too broad, especially if you sell different products to different buyers or the same product to different buyers at a company because each group goes on its own journey. This is particularly a problem for expansion into existing customers. The classic account-based journey says once they bought one product, that account is now a customer. But if your policy is to route leads from a customer to the CSM, you miss out on a different person and a different buying group looking at a different product. So, if leads are too narrow and accounts are too broad, buying groups might be just right. That’s why it makes sense, and people are talking about it.

Alice Walker 08:11

Kerry, anything to add regarding the current momentum we’re seeing in the market?

Kerry Cunningham 08:16

First of all, amen to everything John said. I think there’s a rapidly growing realization that the lead-based approach doesn’t work. One of the key elements of a maturing marketplace is that most B2B organizations have adopted some form of targeted account approach. Once you do that and start generating more demand from a smaller set of accounts, the immediate symptoms of whether it’s working are more leads from the same accounts, fewer leads from other places, and a lot more anonymous traffic from those accounts. If you cannot notice and take action on whether that’s happening, you miss out on a lot of the value of your ABM approach. Many organizations realized over the last few years that they’re not getting the value they expected from ABM because they’re missing all the signals that tell them it’s working and point them in the right direction. That’s one of the aspects, plus everything that John said.

Alice Walker 09:48

One of the things we’ve started to see, which relates to this, is that larger organizations, like Adobe, are really rallying around buying groups. Any thoughts on what’s driving that for these larger enterprises?

Evan Liang 10:05

I’ll second what John and Kerry said about this trend making sense. Two things are driving momentum in large enterprises. One, companies are now leading the forefront in making this happen. The idea of buying groups has been around since the beginning of B2B selling. If you look at CRM, it has opportunity contact roles, so the notion of buying groups was there. But it was really hard to make it happen. There weren’t examples of people who had done it. Now, companies like Siemens and Reltio are leading the way, so there are examples to follow. Two, from a technology perspective, we’ve reached a stage where we can automate enough things to make buying groups operationally automated and a reality for larger companies. Initially, sales reps had to manually enter data into the CRM, which was a huge ask. But with technologies like Demandbase and LeanData, we’re now able to automate much of this process, making buying groups operationally viable for large enterprises.

Jon Miller 11:44

Although I’d argue we’re still

at the 20-yard line, not the touchdown. I’ve never been a fan of using the opportunity object and the opportunity contact role to manage buying groups. It’s the best thing we have today, but it’s fundamentally the wrong object because it requires creating opportunities before a salesperson thinks of it as an opportunity. The technology has gotten us closer, but we’re not there yet.

Kerry Cunningham 12:36

We dealt with that question a lot at Forrester. One of the objections we’d get all the time was, “You can’t touch my opportunity object.” There is a simple fix, though culturally difficult. You just have pre-sale stages for the opportunity, ensuring you’re not messing up sales forecasting. The issue is cultural and getting over the heartache it causes sales and sales ops when you touch that sacred object.

Jon Miller 13:36

Another point is that other technologies read Salesforce, and if they aren’t sophisticated enough to look at the opportunity stage in terms of inclusion, it can go wrong. But it’s a process. I wouldn’t argue that you shouldn’t be doing it today because we want to move forward with buying groups, and it is the best we have today.

Evan Liang 14:09

We see folks doing $0 ops and moving in earlier stages. There is a way to have your cake and eat it too, involving custom objects sitting on top of the CRM. Technically, there is a way to make this happen, but taking those first steps toward managing better opportunities is necessary for most people to go on that journey.

Jon Miller 14:55

I just wanted to add a little controversy to keep things spicy.

Alice Walker 15:00

People come here for the hot takes! They can read an ebook if they want just the facts; they come to webinars for the hot takes. What are the roles or positions pushing for buying group transformation in the organization?

Kerry Cunningham 15:33

It depends on the size of the organization. In smaller organizations, it’s probably the most senior marketing person. In larger organizations, it’s typically the senior director level of demand gen or ABM. People with ABM in their titles recognize they’re getting the short end of the stick—their existing processes prevent them from capitalizing on their efforts. They’re pouring tons into an hourglass with a tiny hole in the bottom.

Evan Liang 16:24

I think we see a lot of folks at the director level pushing pilot projects forward, but you need the buy-in of the CMO and CRO to make this happen. Justifying the ROI is crucial, and Terry at Forrester has a model for it. Sales conversion rates improve with more people in the buying group, uncovering new opportunities missed by lead-based approaches. It’s a combination of these factors that justifies the ROI and gains buy-in from sales and marketing.

Jon Miller 17:16

It’s interesting that both of you see the primary driver coming from the marketing side, not sales or sales ops.

Evan Liang 17:34

I was a bit surprised too, John. Generally, sales feels this is so obvious that they assumed we were already doing it. People in marketing feel the pain of wanting to do more but being unable to, which is why it’s coming from there. The whole organization should be embracing it.

Kerry Cunningham 17:58

I used to do this thing with both sales and marketing folks in the room, asking marketers what happens if they get two or three leads from a target account. Marketing would say they don’t notice when they get multiple leads. My response is, “Don’t tell sales that. Fix it, and then tell them it’s always been this way.” The problem is, sales is often a big part of the issue. Sales imposes rules that say if they get one lead from an account, they don’t want any more leads from that account. That’s one of the primary obstacles—sales needs to understand that multiple leads from an account are a good sign, not interference from marketing.

Evan Liang 19:22

It’s interesting you mention SDR compensation and the role SDRs play in this. Do they get paid for multiple meetings? How do you manage that?

Jon Miller 19:43

I wonder if it’s related to organizations doing a bad job of SDRs for current customers, missing cross-sell and expansion opportunities. SDRs are usually for net new business. I think the most powerful place for buying groups is often in building a machine around your expansion motion.

Kerry Cunningham 20:11

We have a couple of relevant stats. One survey of marketers showed that 74% say they do recognize multiple leads from an account and prioritize them. That’s a big improvement. Another survey of BDRs showed they are multithreading more than half the time, even with inbound leads. If you have leads, those are the ideal other contacts to go after. If you don’t, the only reason to follow up on a lead is because the account is worth selling to. Why call one person and give up? Following up on a lead should be about engaging the whole account.

Alice Walker 21:42

We have an open poll to gauge if organizations are selling into buying groups, either formally or informally. It looks like we have a lot who are, and a lot who are evaluating. As we talk about alignment and structure, how can non-executive stakeholders effectively communicate the importance and impact of buying groups?

Kerry Cunningham 22:20

First, get your act together and understand what your data looks like today. Your data will show buying groups. Look at your leads data and map it to see how many leads per opportunity go to pipeline or revenue. Anonymous traffic is also crucial. In our research with PathFactory, we see that two out of ten people in a buying team will fill out a form, while three out of ten won’t. You need to see who’s on your website and who’s going to buy from you. When you show this data to leadership, it makes an impression. Then they’ll ask how to do it, and that’s where you can bring in the technology.

Jon Miller 23:51

The struggle is knowing if five people on your website are part of one buying group or two. If they’re anonymous, you can only anonymize to the account level. Technology hasn’t caught up to aggregate anonymous signals into interest segments yet.

Kerry Cunningham 24:35

You can, but it’s not always easy. AI helps read and tag your content. Geography can help if you can pinpoint location. As people move down the funnel, you layer on additional signals, segmenting campaigns, and using triggers to form buying groups.

Jon Miller 25:22

Once you get to known opt-in information, you can do more cool stuff.

Alice Walker 26:01

There’s a technology piece and a cultural component. If you have a large-scale organization with siloed departments, both culturally and literally, how do you start implementing such a wide-scale change?

Kerry Cunningham 26:43

This can seem overwhelming, but you can start small. Look at your leads data and see if buying groups are looking at your content. Set up reports and start circulating them to account owners and BDRs. Even if it’s low-tech, it starts making the case. If you use intent data, attach it to the leads. Technologies like Demandbase and LeanData automate these processes, making it a better experience for those following up.

Evan Liang 27:55

Starting with a small pilot project is effective. Take a specific product or region, run a pilot, showcase the data, and present it. The ROI from these pilots can be enormous, potentially uncovering hundreds of millions in potential ROI. You may not need higher-level approval to pull this off.

Alice Walker 28:31

Let’s talk about marketing trends and expectations, specifically ABM. John, what do you think the buying group motion means for ABM efforts?

Jon Miller 28:50

It ties directly to what Kerry said. The ABM team is often the primary driver for buying groups. Everything people wanted to do with ABM, they want to do with buying groups. ABM was the easier first baby step into it. Having an intentional focus on who you want to go after, understanding where they are in their journey, giving appropriate, personalized interactions, and measuring at that level should apply to a buying group framework as well. We’ll discuss new metrics later.

Alice Walker 29:51

Evan, anything to add?

Evan Liang 29:54

Buying groups encompass all previous approaches. A buying group can be as small as one person, depending on the product and segment. It’s a broader framework that accommodates MQLs and ABM metrics. It allows for multiple motions depending on the sales process and buying committees.

Alice Walker 30:38

Kerry, anything you want to add?

Jon Miller 30:42

One thing I’ve noticed is that marketing automation platforms today aren’t sufficient to support buying groups. Marketing automation was built for lead generation, ABM platforms for account-based approaches. For buying groups, we may need another generation of platforms.

Kerry Cunningham 31:41

Let’s talk about intent data. It’s ubiquitously misunderstood. Intent data is a great early warning system for accounts that might be in market, and it’s a buying group signal, not a single individual signal. The same goes for anonymous traffic on your website. If there are multiples, that’s a buying group signal. When you combine anonymous traffic, intent signals, and known people on your website, that’s a signal we care about. Technologies today automate these processes, making them more efficient. However, we still lack the persistence of that signal through to

the time a deal is closed. It’s difficult to figure out the relationship between early signals and closed deals.

Evan Liang 34:03

I agree, the technology is in early innings. But larger companies are moving to buying groups because they’re not getting full utilization of their existing technology. Agile technology for buying groups makes full use of the CRM in a way that was promised but not delivered.

Jon Miller 34:59

I would argue that just as marketing automation wasn’t sufficient for ABM, current platforms won’t be sufficient for buying groups either.

Alice Walker 35:13

If organizations have entrenched metrics around demand generation and ABM, how should they think about buying groups? Is it an integration, a siloed beta test, or something in between?

Jon Miller 35:47

Did I see you write something once about how you hate the idea of the double funnel?

Kerry Cunningham 35:53

Yes.

Jon Miller 35:56

Maybe you should speak first.

Kerry Cunningham 36:04

For organizations where the buyer is a group of four or more, a lead-based process isn’t okay. There are better ways to look at who’s in market and identifying them. We want people to start looking at other metrics while still reporting traditional ones. Understand the lift when you get multiple leads in an account, engage multiple individuals, and look at the difference it makes. Start with the current funnel but incorporate new signals.

Jon Miller 37:02

I’ve seen companies run lead-based and buying group-based frameworks side by side. The trick is whether they are exclusive. If an account has an MQL, can it also be a marketing qualified account? The goal is to measure both MQLs and in-key ways without getting wrapped around the axle on metrics.

Kerry Cunningham 37:51

Our natural progression with customers starts with more information about the account, prioritizing MQLs based on account scores and in-market signals. BDRs prioritize based on this, and we see the difference in performance. Then, we move to prioritize leads based on account information, not lead information, driving engagement with the whole account.

Evan Liang 41:29

One reason to run them side by side is to avoid being too dogmatic. Different segments, like commercial and enterprise, behave differently. Buying groups can encompass different sizes and types, depending on product and segment.

Alice Walker 42:01

What’s the right way to measure and incentivize buying groups?

Kerry Cunningham 42:20

Measure the extent of engagement and understand whether you’re aligned on the right set of accounts. Marketing’s job is to engage the buying team, convincing them of the right brand and solution before they make a decision. Look at how many individuals you’re engaging, the likelihood of getting an opportunity, and the impact on conversion rates.

Evan Liang 43:12

Number of people in the buying group and the Delta of additional adds are key metrics. Identify what’s missing and hand that to marketing to drive higher conversion rates.

Jon Miller 44:09

Metrics should include coverage (how many people in the buying group) and where each buying group is in their journey. Tracking movement and progress of buying groups from cold to aware, in market, etc., is crucial. I call these Qualified Buying Groups (QBGs) and think they should be the new goal for marketing and sales.

Kerry Cunningham 47:02

One last point: marketing source attribution is a pathway to irrelevance. We need to look at all activity and its impact on the set of accounts and buying groups, focusing on total pipeline created and not just individual contributions.

Alice Walker 47:40

Let’s move to the Q&A. If you have more questions, please add them to the Q&A section.

Evan Liang 47:50

I think we can see that we’re still in early stages, and this conversation is just starting. The idea of buying groups being “just right” like Goldilocks is a key takeaway. The focus on metrics and bridging gaps in technology is crucial.

Alice Walker 48:49

Our first question: How do you model buying groups for quarterly planning? Do you still build your targeting models on MQLs?

Kerry Cunningham 49:11

No, targeting models based on MQLs are generally fiction. Start with the right set of accounts and determine how many opportunities you expect to develop. Look at historical data for lead and anonymous traffic to model future opportunities. Use real data to create accurate models.

Jon Miller 51:01

One point to add: we should avoid trying to credit opportunities as marketing source or sales source. It’s a team effort, and trying to attribute credit is always going to be false. Moving to team-based goals aids the adoption of buying groups.

Alice Walker 51:36

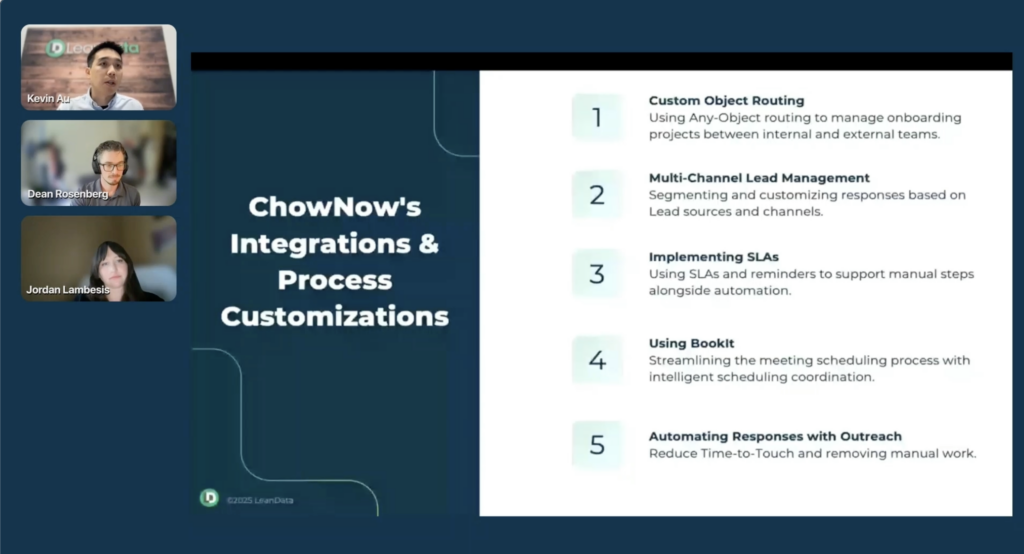

Our next question: Evan mentioned customers working effectively with buying groups today. Can we get more detail about how they’re doing that and how they’re using LeanData?

Evan Liang 52:13

Companies like Siemens and Palo Alto Networks are early adopters, using LeanData for workflow and automation. They’re transitioning from a lead-based approach to an opportunity or buying group approach. Our technology helps automate processes like converting leads into contacts and adding opportunity contact roles without requiring salespeople to do it manually. This automation helps customers move toward a buying group approach.

Alice Walker 53:24

Final question: When does a pilot work well for setting up new metrics for measurement?

Kerry Cunningham 53:42

A pilot works well for anything making a big change. It allows you to experiment and see the impact before fully implementing.

Jon Miller 53:51

I agree. A pilot helps transition and avoids potential pitfalls. It’s a necessary step for significant changes.

Alice Walker 54:00

One more question: Should each team have a champion for buying groups?

Kerry Cunningham 54:15

Probably works best if there is at least one champion.

Evan Liang 54:20

A true CRO should be able to look across and be the ultimate champion, though not all have that purview.

Alice Walker 54:43

Last question: If marketing shouldn’t be held to a source pipeline metric but is expected to generate pipeline, is the new metric a buying group engagement metric within target accounts where pipeline doesn’t currently exist?

Jon Miller 55:43

It’s an “and” not an “or.” Measure engagement and movement of buying groups towards pipeline, and measure total pipeline created. Avoid trying to attribute credit to marketing or sales separately.

Kerry Cunningham 56:01

Look at all activity and its impact on accounts and buying groups. Focus on total pipeline created, not just individual contributions.

Alice Walker 56:43

Thank you all for attending. A reminder: the on-demand version of this session will be in your inbox tomorrow. Have a great day!

Evan Liang 57:01

Don’t forget to scan the QR code to download the authoritative guide to buying groups. It’s filled with useful information.

Alice Walker 57:42

Thank you all, and have a great day!