Summary

Palo Alto Networks’ Marketing Operations leaders share how they operationalized buying groups at enterprise scale, shifting beyond MQLs to orchestrate complete buying committees. This session is for RevOps, Marketing Ops, and Sales leaders who want measurable pipeline lift and better sales alignment. The headline takeaway: buying-group activation drives bigger deals, faster progression, and higher win rates.

Key Takeaways

- Buying Groups outperform MQLs. Opportunities with defined buying groups show 15x progression to forecasted pipeline, 3.3x higher deal size, and double the win rate.

- Buying Group completeness is now a top-line KPI. Palo Alto Networks replaced MQL volume metrics with buying group engagement to measure real marketing value.

- Sales visibility drives trust. By linking personas directly to opportunities, sales teams gain context to prioritize outreach and improve close rates.

- Scoring fuels activation. A Buying Group Score measures intent, engagement, and completeness so marketers can target accounts by readiness and persona mix.

- Cohorts guide campaigns. Marketers use four activation cohorts: Win Now, Pipeline Acceleration, Contact Acquisition, and Brand & Demand. This helps choose the right tactics and spend levels for each account.

Speakers

Lauren Daley, Director, Marketing Operations, Palo Alto Networks

Lauren is one of the architects of Palo Alto Networks’ buying-group strategy and KPI framework, focused on enabling marketers and sellers with actionable signals.

Jeremy Schwartz, Sr. Manager, Global Lead Management & Strategy, Palo Alto Networks

Jeremy leads buying-group activation across BDR, sales, and marketing teams, with an emphasis on campaign-to-opportunity impact and sales visibility.

What You’ll Learn

Q: How does Palo Alto Networks define and score buying groups?

A: Each buying group includes 10–15 personas categorized by influence level: C-suite decision makers, VP and director-level influencers, and practitioner contributors. The Buying Group Score combines engagement, intent, and completeness to determine which accounts are most likely to convert.

Q: What are the key results from adopting a Buying Groups motion?

A: After two years of measurement, opportunities with complete buying groups advanced to forecast 15x more often, generated 3x larger deals, and doubled win rates. These outcomes helped marketing earn organizational buy-in and establish Buying Group completeness as a top-line metric.

Q: How do marketers activate accounts using Buying Group insights?

A: Palo Alto Networks built a four-quadrant activation model that guides campaign investment by Buying Group Score. Teams use this framework to align channels: paid media, nurture, events, and BDR outreach, around the accounts most likely to progress.

Session Transcript

Jeremy Schwartz

Good morning. Are we on? Can you hear me now? All right, cool.

Lauren Daley

All right, thank you for joining us. I’m Lauren Daley, Director of Marketing Operations at Palo Alto Networks.

Jeremy Schwartz

I’m Jeremy Schwartz, Senior Manager of Global Lead Management and Strategy at Palo Alto Networks.

Lauren Daley

And just a little bit about Palo Alto Networks, although you guys are all in Silicon Valley right now. We’re a cybersecurity company selling multiple product line solutions mainly to enterprise customers, and all of those customers are making buying decisions in a buying group. That is why we started on this journey.

Jeremy Schwartz

Yeah, absolutely. No one person is buying Palo Alto Networks software. We’re the largest cybersecurity company in the world, and our CMO and CEO have coined the term “platformization.” We want to sell a lot of stuff to a lot of people.

Lauren Daley

We’ll talk through why buying groups are important, how we define them at Palo Alto Networks, how we think about our Buying Group Score, and how we work with our marketing team to activate targeting efforts based on these buying group signals. We’ll close out with a few key takeaways.

Jeremy Schwartz

Yeah, should be a really interesting session. We love questions on this.

Lauren Daley

Okay, so I took this from Amy and Terry at Forrester. All of you probably know this: 84% of B2B buying decisions are made by a group of two or more, 39% of which consist of four or more people. I think this applies to most organizations these days. It just further validates that buying groups are important.

Jeremy Schwartz

Yeah, and we see it in all segments, even SMB. Because when you think about it, even in SMB, you’ve got a decision maker and a researcher, or a decision maker and a practitioner. Even a buying group of two matters. No one single person is buying.

No one is buying $300,000 worth of software by themselves.

So I want to talk about what it means to market to and sell to a buying group universe. This is where everybody is right now. We’re all staring at MQLs, hyper-focused on them, and oftentimes those MQLs aren’t even tied to revenue. It’s just the target someone set. But if we focus only on MQLs, we’re missing the bigger picture.

What about the people who visited the website but didn’t fill out a form? What about people engaging with you on second and third-party sites like TechTarget or CMO.com? And then there are those elusive C-level and finance personas who approve deals but rarely engage directly with marketing.

In a buying group world, signals like views and clicks become much more important than they are in an MQL world where you only care about form fills.

So how should marketers, ops people, and sellers think about the world in a post-MQL environment? There are two motions we try to drive: creating net-new opportunities and influencing existing opportunities. At a company like ours, where there are open opportunities for every named account and product, sourcing is less important. Influence becomes the key metric.

In an old MQL world, you measured MQL to opportunity. I talk about campaign to opportunity. If you get 100 people to respond to a campaign, and 10% convert, you have 10 MQLs and 90 people forgotten in nurture. But maybe 10 or 20 of those are from the same accounts and should be worked on in a multi-threaded sequence by BDRs.

And what about people connected to open opportunities? You can bring them into the opportunity contact role, giving sellers validated buying group members and context they trust.

Lauren Daley

The results speak for themselves. As Jeremy said, we’re focused on delivering better value to sales by giving them full visibility into buying group activity. They have context to inform discussions and move deals forward.

We’ve seen 15x progression to forecasted pipeline when a buying group is present, 3x larger deal sizes, and double the win rate. These are results we’ve been measuring for about eight quarters.

When you focus on results like this, everyone cares. I can talk to leaders in IT, sales, or marketing—everyone understands these metrics. Attribution is a marketing conversation, but deal size, pipeline progression, and win rates resonate across functions.

Jeremy Schwartz

It’s about adding value, not attribution.

Lauren Daley

This year, our marketing leadership team agreed to a new top-line KPI focused on buying groups. This was huge because our previous top-line metrics focused on MQL volume and MQL-to-opportunity conversion. Our marketers were targeting individual personas but not doing a good job of packaging them into buying groups.

So our new focus is on buying group completeness—ensuring our marketing team engages the complete buying group for top-tier accounts so sales can take advantage of those interactions. That’s tied to our Buying Group Score.

Jeremy Schwartz

I’ll talk about that. Everything we’ve done has been proven by results. We started small, we grew, and now we’re a significant contributor to pipeline and revenue through buying groups.

Lauren Daley

At our company, we’re lucky to have a data science team that analyzes won and lost deals to understand which personas engage, what their interactions look like, and their level of influence.

Our buying groups typically include 10 to 15 personas. Primary personas are C-level, showing up in almost all closed-won deals. VP and director-level roles are high influence, and practitioners are medium influence—they still matter because they influence decision makers.

Jeremy Schwartz

Exactly. Understanding your buying group composition is key. Not everyone in IT or marketing is part of a buying group. You need to identify the right mix of personas.

We developed a scoring model to measure engagement, intent, and completeness. For example, if your ideal buying group has 10 personas and 5 are engaged, that’s 50% completeness. Seven out of ten is 70%.

When we have majority completeness, even if we have no MQLs, we bundle those engaged personas and give them to BDRs as a group. Marketing also activates them with tactics like paid media and email to surround them from both sides.

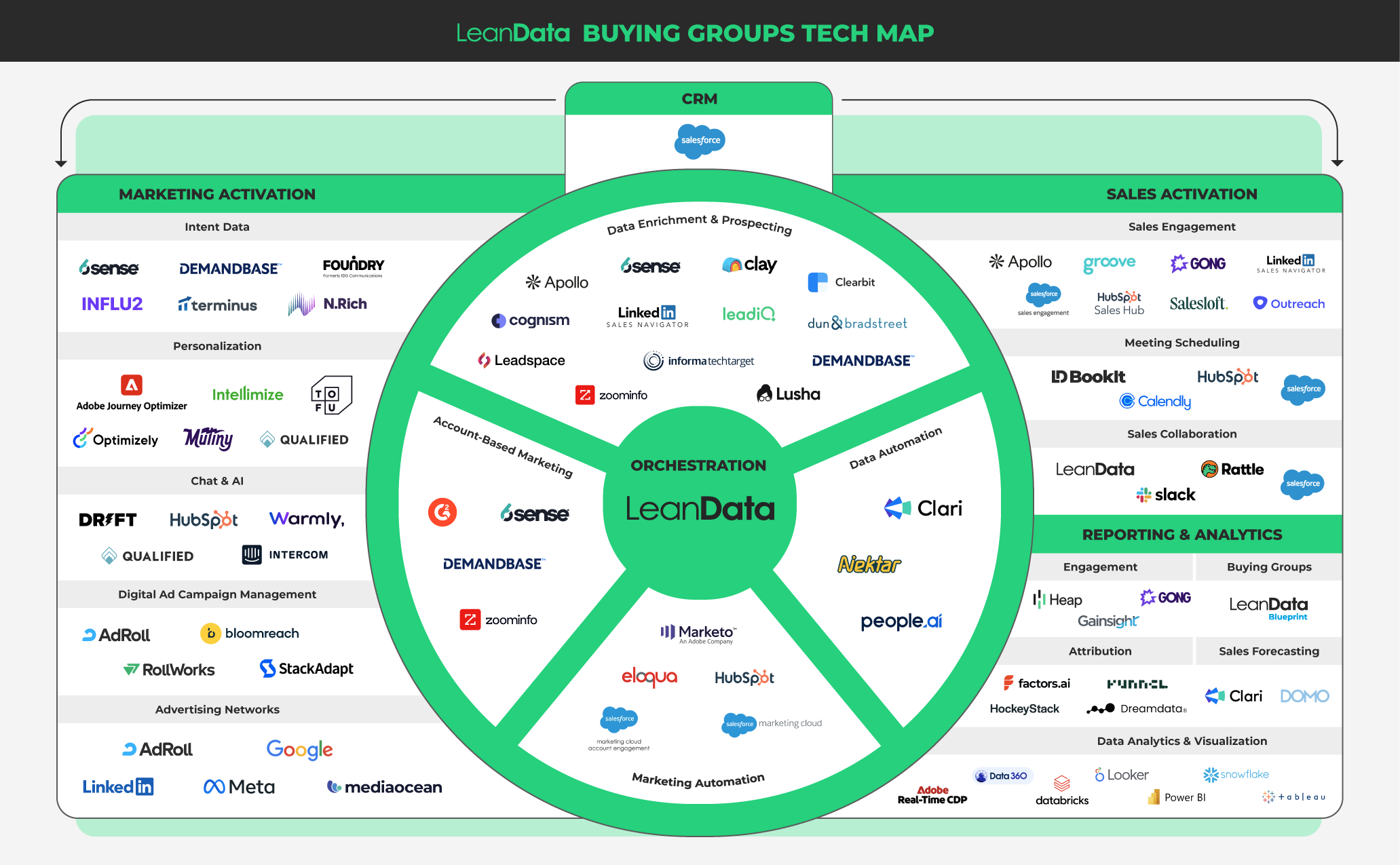

This score lets us embed activation logic directly into our systems. We built it side by side with LeanData’s buying group object.

We also created a simple four-quadrant activation framework—Win Now, Pipeline Acceleration, Contact Acquisition, and Brand & Demand—so marketers can choose the right play based on their campaign strategy.

Lauren Daley

What Jeremy just mentioned is what we’re doing now—using the score we created to help teams activate. We’re pulling that score into Demandbase so marketing can build audiences by engagement and completeness.

Paid media might focus on identifying missing personas, while field marketing focuses on accounts with full buying groups that need higher engagement.

Jeremy Schwartz

Buying groups naturally create a RevOps motion. They foster partnership between sales and marketing—and even within marketing—because everyone understands their role in activation.

And buying groups aren’t static. You have to refresh your data. Two years ago, no one had “AI” in their title; now many do. We refresh our buying group data twice a year and recommend others do the same.

Speaker 2

Could you talk about the key components of your tech stack that made this possible?

Jeremy Schwartz

Sure. We use Salesforce as our CRM, Marketo, and then three key platforms: LeanData, Demandbase, and Outreach.

We use LeanData for contact-to-opportunity matching, Outreach for sequencing, and Demandbase for signals. One of our first steps was filtering Demandbase data to find active, engaged people in our CRM.

Speaker 3

You’ve painted a compelling picture. Are there any downsides, and is the program fully rolled out?

Lauren Daley

We’re fully rolled out. Right now, the focus is on helping our marketing team understand how to use these signals. Budgets are tight, but targets keep increasing, so we’re helping them prioritize accounts with the highest potential.

Jeremy Schwartz

We started small with a BDR pilot—fully manual at first—then automated and expanded. By the end of the first year, we were scaled across BDR and sales. The second year, we took it on a “road show” through marketing to teach teams how to use buying groups effectively.

Lauren Daley

When we say full scale, it means we connected all buying group signals, members, and data into one view for sales. We even created our own custom buying group object since we didn’t have budget for LeanData’s at the time.

Jeremy Schwartz

Exactly. On the marketing side, we helped campaign managers run small pilots, learned what worked, and built a playbook for broader use.

If you want to start with buying groups today, shift your top-of-funnel focus from targeting 70% decision makers to 70% buying group coverage. That single change will cascade through your entire motion.

Speaker 5

Did you start with a small group of accounts or a specific region?

Lauren Daley

We started with our BDR team—the people we hand leads to. Sales already thinks in buying groups; they call it “the right people on a deal.”

We focused on BDR managers who were willing to participate. We spent six months gathering measurable results, then projected those results across a full fiscal year to show leadership the potential impact. That’s what earned executive buy-in for full automation and scale.

Jeremy Schwartz

We’ll take more questions afterward. Thank you all.