For many B2B organizations, the traditional lead-centric model has reached its limits.

Complex buying journeys and long sales cycles demand a new approach. That is why Siemens and Palo Alto Networks shifted to a Buying Groups motion.

Their results? Bigger deals, faster pipeline progression, and stronger sales and marketing alignment.

Recently Lauren Daley, Director of Marketing Operations at Palo Alto Networks, and Martin Hasenstrauch, Global Channel Marketing at Siemens Digital Industries Software, pulled back the curtain on their journeys during a LeanData webinar.

Here’s how they made the transition and what they learned along the way.

Why Siemens & Palo Alto Networks Moved Beyond MQLs

Both Siemens and Palo Alto Networks recognized the same problem: their lead-centric processes no longer reflected how their customers actually bought.

At Siemens, sales and marketing teams felt frustrated with the status quo. “There was a lot of friction between the organizations,” says Martin.

Siemens had worked with Forrester consultants for several years. They saw a Buying Groups motion as a way to reduce friction and match how sales already operated. “A good salesperson has always sold to different types of buyers — the financial buyer, the technical buyer, the promoter, the detractor,” Martin explains.

Palo Alto Networks faced a similar situation.

“Our sellers are already selling to the buying group,” says Lauren. “Yet, on the marketing side, we were still handing off leads one by one to the sales team.”

Plus, marketing budgets remained flat while pipeline targets increased. The team needed a more efficient process to improve lead conversion rates. Aligning around buying groups became the clear choice.

Starting Small with a Pilot

Both organizations chose to begin with a small, time-bound pilot.

Palo Alto Networks did not start with top-down executive support. First, Lauren’s team proposed a pilot to prove the concept. “We were pretty strict about first discussing strategy and theory for about two months,” she says. “Then we ran a pilot for about three or four months.”

Siemens also began with a pilot. They partnered with sales to define the pilot’s scope and success criteria. “We worked together to try and change the way we work,” Martin says.

Both pilots relied heavily on collaboration between sales and marketing. Neither tried to automate everything right away. Palo Alto Network’s pilot was manual to start, and then they built in automations. This approach allowed them to learn and adjust before scaling.

Tackling Technical Challenges

Shifting to a Buying Groups motion presented technical hurdles, especially within their CRMs. Many CRMs are still built around leads and contacts rather than buying groups.

Siemens initially tried to manage a Buying Groups motion by adding multiple contacts to opportunities. However, this did not create meaningful change until they redesigned their processes.

Palo Alto Networks faced similar challenges. Their Salesforce instance was not structured around buying groups. As a result, they had to figure out where buying group data would live.

To bridge the gap, Palo Alto Networks used Demandbase for buyer intent data and LeanData for automation. Specifically, they leveraged LeanData’s contact to opportunity matching. This eliminated manual work and provided sales reps with context about each buyer’s engagement.

Siemens also integrated intent data and LeanData into their processes. These tools helped both companies collect signals from multiple sources and surface them for the right team members at the right time.

Overcoming Resistance

Both teams knew that process changes would require buy-in from multiple stakeholders.

Sales alignment was surprisingly smooth. Lauren says, “As long as you speak to sales in their language and explain the value, they love it.”

However, technical teams, especially sales operations, were more hesitant. Lauren described resistance from sales ops teams who worried about disrupting reporting and forecasting. Palo Alto Networks struggled to get sales operations to recognize the value and think beyond how they had set up their reporting.

To overcome this, both Siemens and Palo Alto Networks focused on education. They worked to help marketing, sales, and even partners understand the benefits of a Buying Groups motion.

Measuring What Matters

Once the pilots launched, both companies had to rethink their success metrics.

Siemens moved away from measuring only marketing-sourced pipeline. Instead, they focused on how marketing influenced pipeline progression and deal outcomes. This change gave them better ways of measuring the outcomes of a Buying Groups motion.

Palo Alto Networks introduced two new metrics:

- The first was buying group completeness. How many key personas within a buying group were engaged?

- The second was opportunity coverage. What percentage of opportunities had buying groups attached?

By tracking these new metrics, both companies gained better insights into how their marketing efforts supported revenue growth.

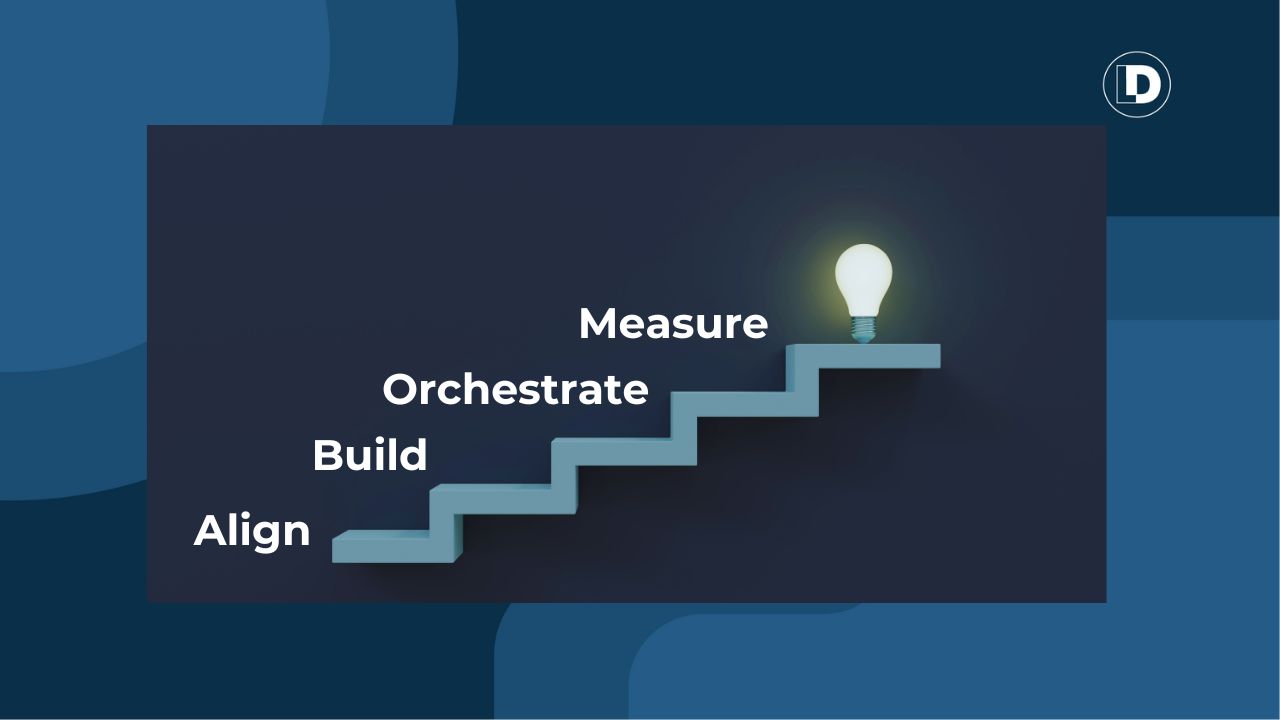

The Results Speak for Themselves

The impact of the Buying Group motion was clear. Both organizations reported significant improvements in key sales and marketing metrics.

At Palo Alto Networks:

- Opportunities with Buying Groups progressed into forecasted pipeline 17 times more often than solo-contact opportunities.

- Deal sizes were 2.3 times larger.

- Win rates increased by 17%.

- During the manual pilot phase, Buying Group opportunities had double the win rate compared to solo-contact opportunities.

At Siemens:

- More deals entered the opportunity stage.

- Deal sizes increased by 2x.

Even more importantly, both companies experienced stronger collaboration between sales and marketing. “It created a really good feeling of cooperation,” Martin says.

Their Best Advice: Start Small and Learn

When asked for advice to other organizations, both Lauren and Martin gave the same recommendation: start small.

Lauren emphasized that getting started does not require big budgets or sweeping changes. She advised using what’s already within your existing tech stack and run a pilot. Surprisingly, a manual pilot was beneficial because it provided a lot of learnings.

Siemens had a similar experience. Doing a pilot forced the issue and made them carry on with the new processes. Once the teams saw results, no one wanted to return to the old way of working.

Buying Groups Are Driving Growth—Are You Ready?

Siemens and Palo Alto Networks demonstrated that shifting to a Buying Group motion is not just theory. It delivers real, measurable results.

Both organizations started with small pilots, overcame technical and cultural challenges, and embraced new success metrics. Plus, with tools like LeanData and Demandbase, they were able to scale their efforts efficiently.

For enterprise organizations still relying on MQLs, the question is no longer why change?

Instead, it‘s why wait?