What happens when an insurance inquiry or claim gets lost between a web form and an agent?

Too often, the answer is nothing: no follow-up, no quote, and no sale.

That’s the hidden cost of legacy inquiry distribution systems, especially in the insurance industry, where complex team structures, regional licensing, and outdated CRM setups make it easy for quote requests, applications, and claims to fall through the cracks.

But here’s the good news: You don’t have to rebuild your CRM from the ground up to modernize your routing and distribution. You just need a smarter way to connect the dots between people, policies, and processes.

In this article, we’ll explain the challenges holding back insurance operations and how modernizing quote and claim distribution can unlock revenue and efficiency gains across the entire go-to-market engine.

Why Insurance Inquiry Distribution Breaks Down

Insurance companies face unique routing challenges that most B2B organizations don’t. The sheer complexity of aligning quote requests, applications, claims, and service needs with the right internal or external resource is enormous.

Here are a few reasons routing and distribution often breaks down in insurance:

- Multiple distribution models: Policyholder requests may come in from brokers, call centers, partner sites, or direct web forms.

- Licensing and regional rules: Agents and service reps may only operate in certain states or lines of business.

- Custom Salesforce objects: Many insurance companies reconfigure standard objects like Opportunities to serve as Policies or Claims.

- Manual handoffs: Spreadsheets, emails, and outdated workflows create bottlenecks.

- No visibility after handoff: Teams like underwriting, claims intake, or member services lose track of whether an inquiry converted or got lost in the queue.

For Sales and Marketing Ops teams tasked with accelerating quote response, and for IT leaders juggling system scalability, these routing issues are more than workflow headaches, they’re business risks.

You Don’t Need a New CRM. You Need New Logic.

It’s tempting to assume that the only way to fix broken routing and distribution is to rebuild your CRM from scratch. But most of the time, the CRM is not the problem. The problem is the logic (or lack of logic) governing how data and inquiries move within it.

When routing rules live in someone’s head or a static spreadsheet, things get messy fast. Plus, when workflows rely on IT tickets or custom code, changes are slow and fragile.

Instead, insurance teams can adopt smarter automation that lives inside the CRM and reflects how their business actually works today.

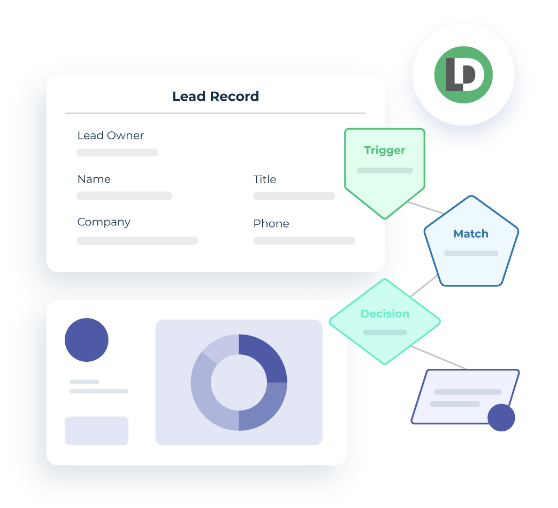

Here’s what that looks like:

- Route quote requests based on product, location, license type, and availability.

- Match inbound inquiries to existing accounts or policyholders.

- Reassign books of business instantly when an agent departs.

- Send inquiries into the right queue or team based on real-time criteria.

- Track SLA performance and reroute if no one follows up.

Modernizing routing and distribution doesn’t require a rip-and-replace approach. It starts with defining business logic in a clear, flexible way and embedding it into daily operations.

- Improve policyholder experience

- Reduce orphaned inquiries

- Track and audit every assignment for compliance

This wasn’t just about speed. It was about saving revenue and protecting relationships.

How Modern Routing Supports the Full Policyholder Lifecycle

Faster response time is a win, but smarter routing and distribution brings value across every stage of the insurance customer lifecycle.

Here’s how:

- New business: Route quote requests instantly to a licensed agent.

- Renewals: Ensure follow-ups reach the right rep on time.

- Claims: Move inquiries across service teams based on type or urgency.

- Cross-sell: Match known policyholders with agents who have relevant certifications.

- Agent transitions: Reassign an entire book of business without manual steps.

Plus, operations leaders get real-time visibility into bottlenecks, SLA adherence, and conversion patterns. That means fewer blind spots and better reporting across revenue teams.

Key Capabilities to Look For in a Modern Insurance Routing System

When evaluating how to modernize routing and distribution, enterprise insurance companies should look for technology that delivers:

- Support for custom Salesforce objects like Policies or Claims

- Cross-object routing logic to reassign related records in one action

- Territory and license-based routing to ensure compliance

- Flexible workflows that adapt to seasonal changes or new team structures

- Audit trails for every handoff

- SLA monitoring and fallback reassignment

Routing and Distribution Technology Checklist

Here’s a quick checklist to guide your evaluation:

- Can we route based on product, region, license, and availability?

- Can we reassign an entire book of business instantly?

- Do we have visibility into SLA compliance?

- Can we avoid duplicates and track conversion outcomes?

- Can business users (not just IT) make changes to the routing logic?

If the answer to most of these is no, your routing and distribution system is holding you back.

Why Data Quality Matters in Insurance CRMs

Even the best routing workflows fail when CRM data is messy.

Dirty data causes:

- Duplicate quote requests and conflicting follow-ups

- Orphaned inquiries with no ownership

- Inaccurate reporting on conversion or retention

- Missed upsell and renewal opportunities

Fixing routing and distribution starts with fixing data hygiene. That includes intelligent matching, deduplication, and clear record ownership across all stages of the policyholder journey.

When operations teams prioritize both data quality and workflow automation, they create a reliable system that can easily scale.

Routing & Distribution are Revenue Strategies

How fast and accurately you respond to a quote request or a claims inquiry determines whether you win business or lose it to a competitor.

Modernizing routing and distribution:

- Speeds up time to quote

- Improves customer experience

- Aligns teams around shared data and processes

- Makes it easier to scale into new regions or product lines

And, you can accomplish all of that without rebuilding your CRM.

So, if your insurance operations team is tired of spreadsheets, ticket queues, and inquiry black holes, it might be time to rethink your routing and distribution, and not your entire system.