After 30+ years in the tech industry, primarily in Sales leadership roles, I’ve collected a lot of tips on how to level up your sales game.

The kryptonite for any revenue team is mediocrity. Everyone has heard the word “mediocrity” and most understand what it is, but not many know where the term comes from.

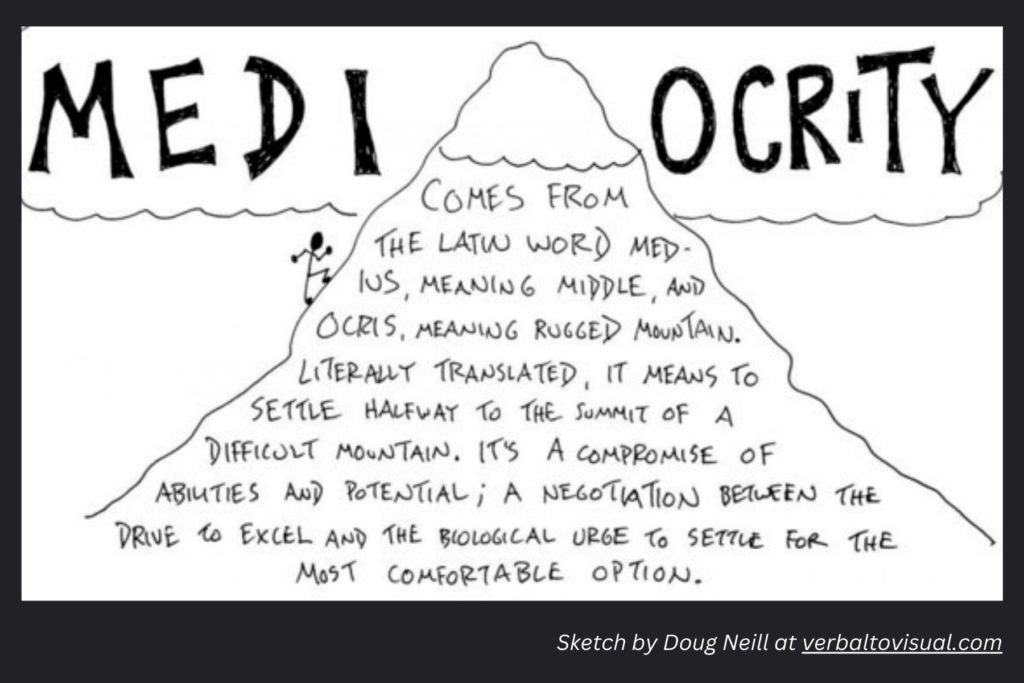

Mediocrity is a combination of two Latin words “medius,” meaning “middle,” and “ocris,” meaning “rugged mountain.” As demonstrated brilliantly in the sketch below, “Literally translated, mediocrity means to settle halfway to the summit of a difficult mountain. It’s a compromise of abilities and potential; a negotiation between the drive to excel and the biological urge to settle for the most comfortable option.”

All sales teams struggle with the potential threat of mediocrity. When times are good and customers are spending, pipelines grow, deals flow and revenue is easier to close. As a result, sales teams can sometimes get complacent and comfortable. This level of comfort can become dangerous. Sales skills can atrophy. Focus and drive can diminish. Comfort can quickly turn into a standard of mediocrity.

To avoid this, sales teams and sales professionals must always be pushing themselves out of their comfort zone. They must always be striving to improve and fend off mediocrity.

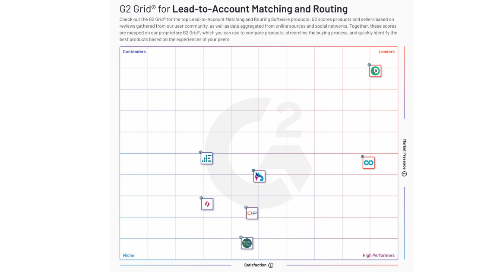

Improvement comes by focusing on four key pillars of sales: customer acumen, product knowledge, sales process discipline, and communication/relationships. These four pillars can help all levels of sellers, from sales development representatives (SDR) to account executives (AE), avoid mediocrity and become a top performer.

Sales Pillar #1: Customer Acumen

Customer acumen reflects an understanding of your prospective customer’s business, industry, company and even individual department knowledge.

When a mediocre seller is assigned a lead, they may take a quick look at the company website, but they won’t research any deeper. This sales rep knows their assigned contact, but has no sense of the department into which their contact reports.

A mediocre seller will only be able to articulate their prospective customer’s problems in generic terms, without depth.

In stark contrast, a top-performing seller will do significant research to understand the prospective customer’s business. This sales rep digs deep during discovery to identify challenges the customer is facing.

Top performers are great at multi-threading, the skill of developing relationships with multiple decision makers at the buyer’s organization. And last, top-performing sellers can describe the buyer’s pain points in great detail, using data and language gathered from the prospective customer.

Customer acumen is a huge differentiator between mediocre reps and top performers.

Sales Pillar #2: Product Knowledge

Product knowledge is a sales rep’s superpower. It helps them overcome objections, have more engaging conversations, and projects a feeling of confidence to the prospective customer.

Mediocre sellers often don’t know enough or feel confident enough to perform discovery or a demo without the assistance of a solutions consultant or a sales engineer. These sales reps tend to shy away from technical knowledge and don’t consider it part of their job. Mediocre sellers don’t seek to improve their sales skills, don’t complete product trainings, and rarely attend product update meetings.

In contrast, top-performing sellers are always learning, diving into product updates, and seeking out training opportunities. These sales reps are skilled at discovery and will often work with a solutions consultant to tailor a demo to the prospective customer’s needs.

Many companies, like LeanData, have a certification program that provides employees and customers with in-depth knowledge of their products. Top-performing sellers are certified in their company’s products and services.

When a sales rep has deep product knowledge, there’s often an accompanying enthusiasm that transfers to the prospective customer, moving the deal closer to the finish line.

Sales Pillar #3: Sales Process Discipline

For a sales team to be effective, there needs to be processes in place and defined steps for every deal in the pipeline.

Mediocre sellers looked at the sales process during their initial training meetings, but probably haven’t looked at it since. For companies using sales qualification methodologies like MEDDPICC® (Metrics, Economic Buyer, Decision criteria, Decision process, Paper process, Implications of pain, Competitions, and Champion), a mediocre sales rep will see this process as a chore, not understanding its value or importance.

Deals often stall because mediocre sellers allow the prospective customer to take charge of the sales process, letting outside forces determine the next steps of the customer journey.

In contrast, top-performing sellers know the sales process intimately and understand the value of systems like MEDDPICC. While they understand the prospective customer’s buying process, the top performer stays in control of the next steps for the customer.

A solid sales process is essential to moving prospective customers through stages of their buying journey. The best sales reps keep deals alive and thriving by sticking to the process.

Sales Pillar #4: Communication and Relationships

Good communication skills help sellers not only relay information about their product, but also help them understand the buyer’s needs.The goal of relationship building with a prospective customer is to create trust. When buyers feel secure with your brand, they are more likely to make a purchase.

Mediocre sellers are aloof, overly casual, and often overly accommodating. They like to send generic communication and will use excuses to not call or talk live to a prospective customer. Mediocre sales reps love sending email.

In contrast, top-performing sellers see themselves as a consultant, teacher, or advisor to the buyer. These sales reps have impeccable written and verbal communication with the buying team and will find any excuse for a live conversation whether on the phone, Zoom, or in person.

Sales is rooted in effective communication that leads to building relationships of trust. Deals will not close without these two essential skills.

Reject Mediocrity Daily

When times are good in an expanding economy, some sales reps, even top performers, may get caught up in their own success. They may get a little lazy and lose some of the drive to improve. Signs of the dreaded “M” word can start creeping in. This all gets exposed in a down economy.

Sales reps then struggle to close deals, they miss numbers and the level of discomfort and pressure become too much. Often they leave the profession altogether. Consistently being a top performer is certainly not rocket science, but requires hard work, resilience and adaptability. It means continuously pushing yourself out of your comfort zone.

My challenge to all sales reps in 2023 is to reject mediocrity daily by embracing what top performers do: look in the mirror every day and commit to improving and driving to succeed. Never settle for the comfortable middle of the mountain. This mindset will get you through any economy, good or bad.

MEDDPICC® is a federally registered trademark of Darius Lahoutifard, exclusively licensed by MEDDIC Academy, and is being used with permission.